This article is about Justworks PEO and Payroll. What product am I using?

Justworks makes it easy for administrators to view and manage their employee's information. Navigate to Manage > Employees, and select an employee.

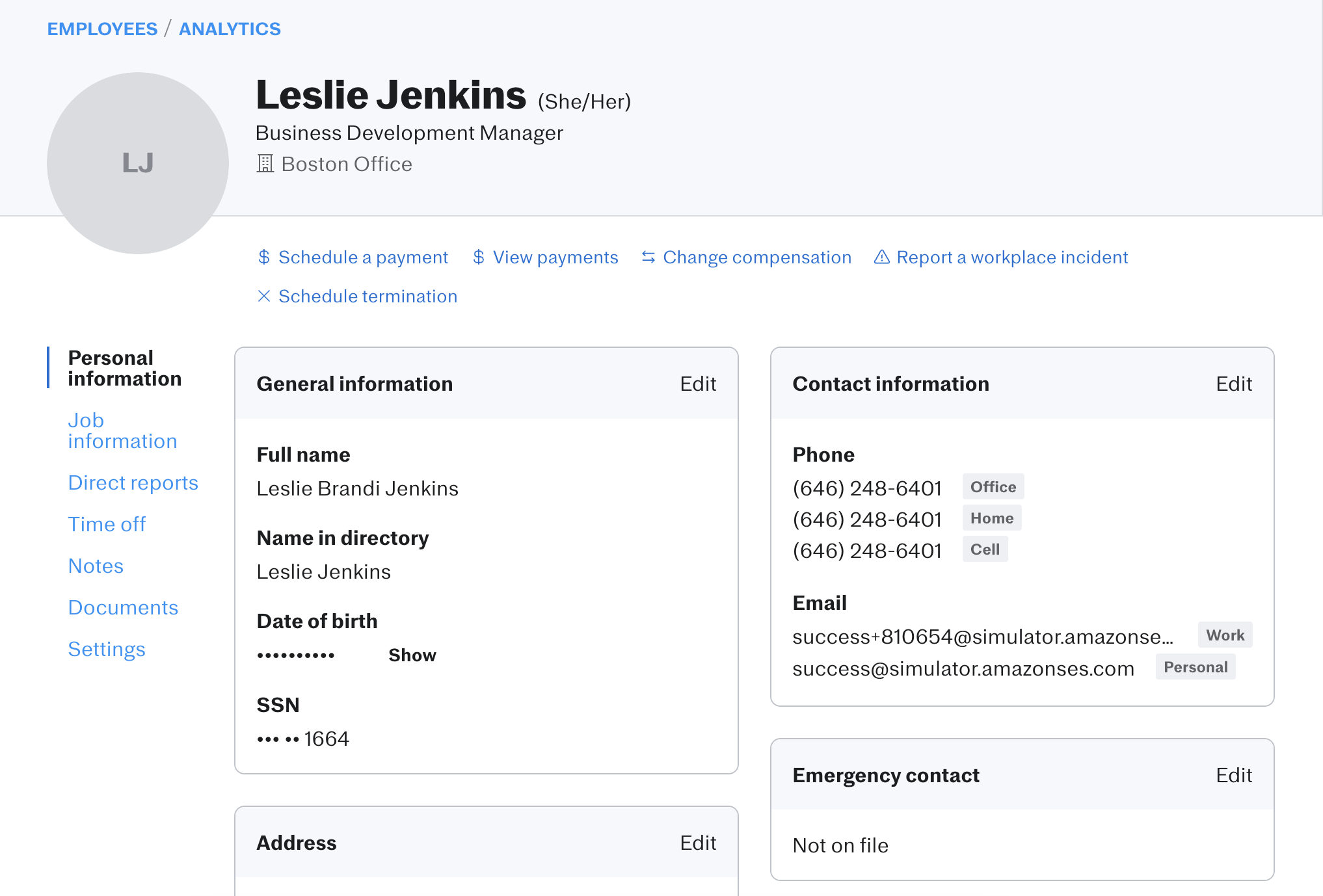

Personal Information

Under “Personal information”, you’ll then be able to view non-sensitive personal employee information including phone numbers, home email address, bank account information and filing/withholding status.

Job Information

By selecting “Job information”, you can see an employee’s title, office, start date, and compensation details. If you've entered any information into the Employment Authorization box, this will also show up from this view. Keep in mind, however, that information entered there is for your reference only.

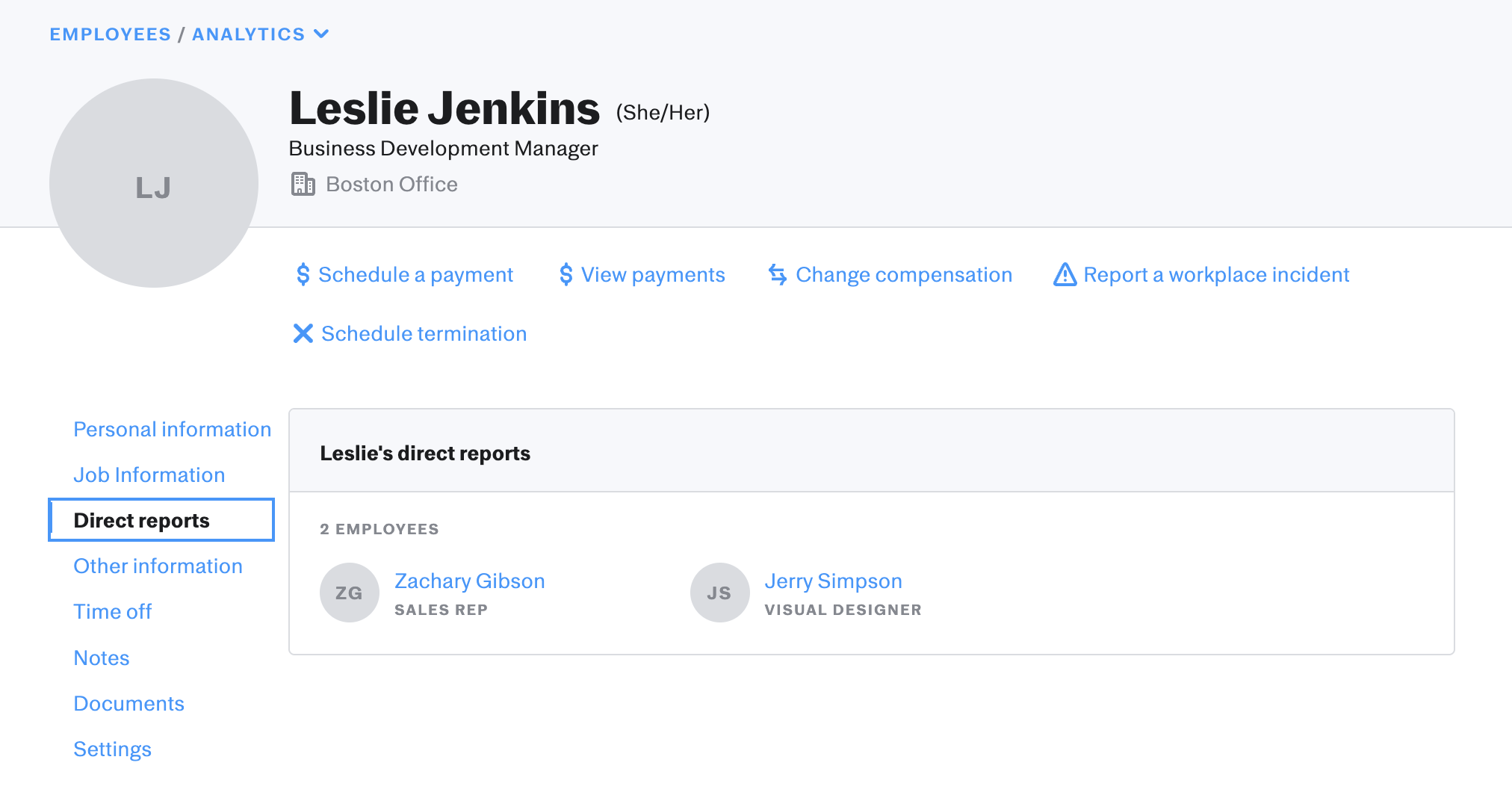

Direct Reports

If this employee has direct reports, you'll also be able to view their information by clicking through to their profile.

Time Off

If you need to make any adjustments to any employee’s PTO, you can do so here as well. The Time Off tab will let you quickly see how many days of a vacation policy an employee has used as well as their remaining balance. On this tab, you’ll also be able to view any upcoming time off as well, making it easy to stay organized and keep track of your team.

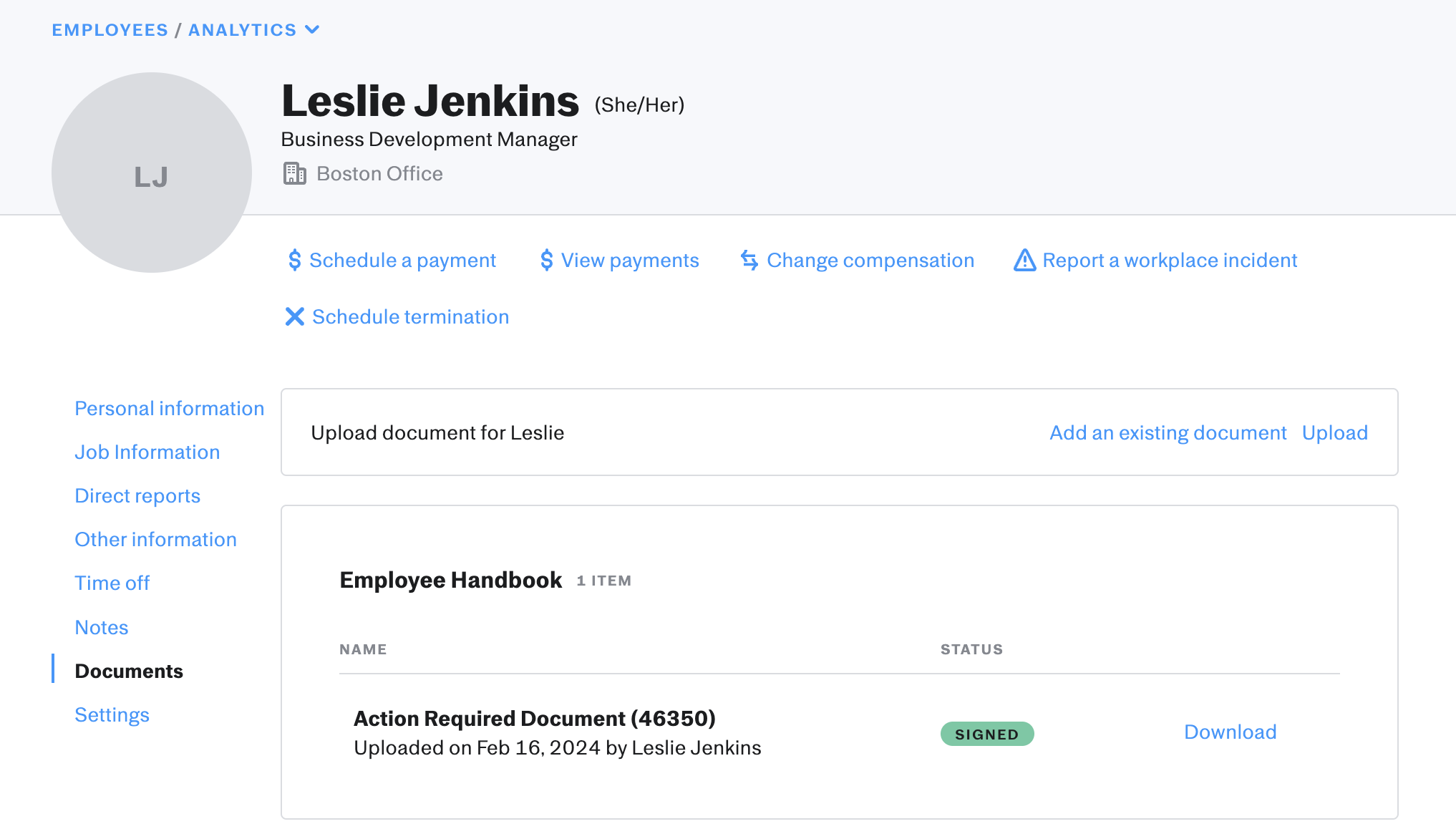

Documents

The Documents tab is where you’ll find important information for your employees, such as their I-9 and W-2, once that’s been generated. You can also upload documents such as contracts here for housekeeping!

Settings

Settings

Finally, under “Settings”, you’ll be able to view and change the permission level your employee may have, as well as if they’ll show in the company directly in Justworks. You’ll also be able to set up manual deductions for these employees here, in case your company has medical, 401(k), or other benefit deductions set up outside out Justworks.

Disclaimer

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, legal or tax advice. If you have any legal or tax questions regarding this content or related issues, then you should consult with your professional legal or tax advisor.